Have you ever wondered if the key to a happier, stress-free retirement could be less about having more and instead about living smarter? If you’re considering a move or seeking ways to maximize your financial freedom after years of hard work, this in-depth guide to downsizing and retirement planning will help you unlock new possibilities for your golden years. We challenge conventional wisdom around retirement, showing how a well-timed decision to right-size your living space can save money, offer vital tax benefit opportunities, and—most importantly—help you simplify your life .

Are You Ready to Rethink Downsizing and Retirement Planning?

For many, the idea of downsizing in retirement is steeped in images of loss—fewer rooms, less space, letting go of memories. But rethinking downsizing and retirement planning reveals another side: one filled with freedom, improved cash flow, and a renewed focus on your happiness. The modern retiree has changing needs, whether that means simplifying maintenance costs, benefiting from capital gains tax exclusions, or reallocating home equity into a smart financial plan. Practical examples abound—consider retirees trading a burdensome larger home for a charming, low-commitment condo, freeing both time and cash for family or travel. Thoughtful downsizing can be a cornerstone of a strategic financial plan, putting you in control of your retirement journey. Before making a move, it's essential to understand your current home’s value, your future financial situation, and how tax planning can create substantial long-term benefits.

Challenging Traditional Retirement Wisdom on Downsizing and Retirement Planning

Traditional wisdom once dictated that you should stay put in your family home for as long as possible. However, with today's diverse retirement options and the rising costs of living, many seniors now find that downsizing and retirement planning offers not just a financial benefit but an emotional and lifestyle upgrade. Selling your home can free up equity, reduce property taxes and maintenance costs, and provide more flexibility for travel, hobbies, or simply enjoying life with less hassle. The key is to approach this decision with a clear-headed understanding of both the tangible and intangible outcomes, and not to let nostalgia override what could be a positive and empowering financial decision.

- Learn how downsizing and retirement planning can simplify your life and improve your financial situation.

- Uncover key tax benefit opportunities such as capital gains tax exclusions.

- Discover financial planning strategies that align with your unique retirement goals.

- Master essential tips for avoiding the most common mistakes when you downsize your home.

Understanding Downsizing and Retirement Planning for a Better Financial Future

What Is Downsizing and Retirement Planning?

Downsizing and retirement planning is the intentional process of moving to a smaller home or less expensive living situation while aligning your financial plan to support your retirement aspirations. It touches every aspect of your future—from managing capital gains and property tax implications, to rebalancing your estate plan and everyday budget. Downsizing isn’t simply about getting rid of stuff; it’s about rightsizing your home and finances for the long haul. It’s driven by both financial needs (like improving cash flow and maximizing tax benefits) and lifestyle desires (less upkeep, simpler living, access to community and amenities). Effective retirement planning pairs this move with strategic investment advice, social security optimization, and thoughtful estate planning.

For example, selling your current home at retirement and purchasing a smaller home can turn built-up equity into disposable assets, reduce recurring property taxes, and cut down on insurance and maintenance costs. This newfound liquidity gives retirees more flexibility to travel, pursue hobbies, or provide support to family. A successful downsize is always coupled with a comprehensive financial plan, taking into account gains tax, new living expenses, and the impact on your social security and estate planning strategies.

Why Downsizing in Retirement Can Simplify Your Life and Save Money

Downsizing in retirement is directly linked to simplifying your life and increasing your ability to save money. With a smaller home, you’re no longer tied to high maintenance costs, time-consuming repairs, or the physical demands of a larger property. Utility bills, insurance premiums, and property taxes can all see significant reductions, strengthening your monthly cash flow and creating additional opportunities for both saving and spending on things that truly matter to you. The best part? The money you save can be directed towards long-awaited travel, hobbies, or gifts to loved ones.

Less clutter means a more organized, peaceful living environment. Many find that downsizing brings a renewed sense of control and independence—qualities that are priceless in retirement. However, to fully realize these benefits, it’s crucial to anticipate costs such as moving expenses, closing costs, and potential gains tax, ensuring your financial planning is thorough. The right approach to downsizing in retirement can be transformative, helping you not only profit and prosper but rediscover what it means to live well in your golden years.

Key Considerations for Downsizing in Retirement

Assessing Your Current Home, Financial Situation, and Future Goals

The first step in downsizing and retirement planning is a meticulous evaluation of your current home and overall financial situation. Begin with a home assessment that considers market value, potential appreciation or depreciation, and the likely costs of selling your home (including commissions, repairs, and legal fees). Next, review your financial plan: What streams of income do you have? What are your monthly expenditures, and how will they change if you move to a smaller home? Analyze your cash flow, social security benefits, and whether downsizing enables you to maximize your retirement savings while aligning with long-term estate planning goals.

It is vital to set clear future objectives. Are you aiming to travel more, relocate to a retirement community with amenities, or be closer to family? These goals should inform whether, where, and how you choose to downsize. By examining your property tax situation and consulting with a real estate agent or financial advisor, you ensure that every decision—whether on location, size of your next home, or timing—serves both your lifestyle and financial benefit.

The Role of Financial Planning and Creating a Strong Financial Plan

Effective financial planning forms the backbone of any successful retirement strategy—especially when you choose to downsize your home. A robust financial plan should take into account your expected cash flow after the sale, anticipate new expenses, and forecast changes to your property tax and capital gains tax liabilities. Collaboration with a financial advisor or investment advisor is strongly recommended; these professionals can help you analyze how the proceeds from selling your home can be reinvested to supplement social security, bolster retirement accounts, or provide liquidity for medical emergencies and unexpected costs.

Your plan should also look ahead to estate planning, focusing on how your assets—including your new smaller home—will be distributed to heirs or charity. By combining scenario analysis (what happens if home values drop?) with realistic estimates of gains tax and closing costs, you create a flexible, responsive financial plan that protects your interests—and those of your loved ones—well into the future.

Choosing the Right Time to Downsize Your Home

Timing is everything when it comes to maximizing the financial benefit of downsizing. If you sell your current home during a robust real estate market, you may net a higher capital gain—but you could also face stiffer competition for purchasing your new home. Consider your health, community ties, and personal readiness along with market dynamics. Are you prepared for a move or would delaying a year or two make more sense financially and emotionally? Consulting a real estate agent familiar with retirement living and tax planning can help you pinpoint the right window to sell.

Remember, the decision isn’t just about money—it’s also about peace of mind. The right time to downsize is when the move aligns with your financial goals, desired lifestyle, and long-term retirement planning objectives. Think holistically, and don’t rush into a major transition without considering all angles and seeking professional advice.

- Evaluate your needs: Assess whether your current home suits your current and future lifestyle.

- Analyze your financial situation: Review income, expenses, savings, and estate plan implications.

- Explore property tax and capital gains tax implications: Understand the potential gains tax and tax benefit opportunities awaiting you.

- Investigate closing costs and moving expenses: Clarify all transactional costs before making a decision.

- Select your smaller home: Choose a location and size that provides community, convenience, and the right balance for your new chapter.

Tax Benefit and Financial Implications of Downsizing and Retirement Planning

Navigating Capital Gains and Capital Gains Tax When You Sell Your Home

One of the most critical aspects of downsizing and retirement planning is understanding capital gains and capital gains tax. When you sell your primary residence, the IRS allows individuals to exclude up to $250,000 ($500,000 for married couples) of capital gains from tax, provided certain requirements are met. For longtime homeowners with substantial appreciation in their current home, this exclusion can represent a tremendous tax benefit and direct boost to your retirement savings. However, any profit above these limits may be subject to the gains tax—so strategic tax planning is absolutely essential.

Proper documentation of improvements, holding periods, and eligibility tests for the exclusion are necessary to avoid surprises at tax time. Work closely with a financial advisor or tax planning expert to project your possible gains tax liability. Proactive steps can help you structure the sale of your home and reinvestment of proceeds to minimize your tax burden and maximize the financial benefit as you transition to a smaller home.

Understanding Property Tax Adjustments with a New Smaller Home

Downsizing typically means a lower property tax burden, as smaller homes tend to have lower assessed values. However, it’s important to research how local property taxes are calculated and reassessed after a sale or purchase. In some regions, you may be able to transfer your property tax base, particularly if you’re moving within the same state or county. In others, your taxes could increase—even if the sale price of your new home is lower—due to how assessments reset. Knowing these factors can shape not just your monthly cash flow, but your overall satisfaction with your financial plan.

Before finalizing the decision to downsize, consult local assesors or property tax professionals to estimate your new liability. These adjustments can influence your total savings from the move, and when included as part of a comprehensive tax planning and retirement planning strategy, can amplify your ability to save money and simplify your life.

Managing Closing Costs and Other Expenses During Downsizing in Retirement

Closing costs, moving expenses, and transaction fees can add up quickly when executing a downsizing strategy. Typical closing costs include real estate agent commissions, title insurance, transfer taxes, and legal fees. You should also budget for potential home repairs to get your current home sale-ready and expect costs for professional movers, storage unit rentals, and any necessary updates to your smaller home. Each of these expenses can erode your expected profit if not proactively addressed within your financial plan.

Smart retirees account for every dollar when planning a downsize, using detailed worksheets or consulting a financial advisor to ensure that all expected and unexpected costs are clearly outlined. In some situations, negotiating with your real estate agent or bundling services can save money. Above all, thorough planning guarantees that moving costs and closing costs do not become unwelcome surprises as you transition into retirement living.

| Scenario | Monthly Housing Costs | Property Tax | Capital Gains Tax Exposure | Cash Flow / Liquidity | Lifestyle Factors |

|---|---|---|---|---|---|

| Keep Current Home | High (mortgage, insurance, maintenance) | Higher (large lot/value) | Low (until sale) | Lower (equity tied up) | More upkeep, possible isolation |

| Downsizing | Lower (smaller home = fewer costs) | Lower (smaller assessed value) | High (one-time, but can use capital gains exclusion) | Higher (access to home equity) | Less maintenance, more freedom, community options |

How Downsizing and Retirement Planning Can Help You Save Money and Simplify Your Life

Cost Savings and Lifestyle Improvements with a Smaller Home

A move to a smaller home can result in immediate and ongoing cost savings. Lower mortgage or rent payments, reduced utility bills, and decreased maintenance costs all add up. This is especially valuable for retirees on a fixed income, boosting monthly cash flow and enabling you to allocate resources to other priorities like travel, hobbies, or supporting loved ones.

Lifestyle improvements matter too. Many retirees find that life in a downsized space is easier to manage, more comfortable, and fosters a sense of community—especially if you downsize to a retirement community with shared amenities. A streamlined environment can provide emotional clarity, reduce stress, and help you better enjoy your retirement years, all while supporting your comprehensive financial plan.

Hidden Costs: What to Watch For When You Downsize Your Home

While the savings are significant, don't overlook hidden costs when you downsize your home. Expenses such as repairs to your current home for sale, upgrades to your new residence, buying updated furnishings, or even renting a storage unit for possessions you aren’t ready to part with, can sneak up on you. Additionally, some retirement communities have entrance fees or monthly association fees that need to be examined closely.

Moving-related expenses, travel between locations, and temporary accommodation costs should be factored into your planning. Ignorance of these costs can impact cash flow and diminish the financial benefit of your decision. A detailed checklist and consultation with a real estate agent or financial advisor can help you anticipate and manage every aspect of your move with confidence.

Long-Term Benefits of Efficient Financial Planning and a Thoughtful Financial Plan

The advantages of combining downsizing and retirement planning aren’t limited to immediate savings. In the long term, a well-executed financial plan means more predictable expenses, optimized estate planning, and greater financial security regardless of market fluctuations. You can profit and prosper by efficiently converting home equity into investments that support your lifestyle, health, and legacy. Integrating a lower property tax bill and avoiding excessive gains tax liability also preserves your nest egg for years to come.

Perhaps most importantly, the peace of mind that emanates from a strong, actionable financial plan—crafted with input from experienced professionals—enables retirees to focus on enjoying life rather than worrying about money. This is the gift of thoughtful downsizing and retirement planning: financial freedom and an enhanced ability to simplify your life.

"Downsizing isn’t just about moving to a smaller space—it’s about freeing up resources to create more opportunities, experiences, and peace of mind in retirement."

Common Mistakes to Avoid When Downsizing for Retirement

Pitfalls in Financial Situation Analysis

One of the top mistakes is failing to fully assess your true financial situation before you downsize your home. Many retirees underestimate recurring costs or overestimate how much they will save by moving. Comprehensive analysis—factoring in everything from existing debt to changes in insurance policies and cash flow—makes a big difference between thriving and merely getting by in retirement. Always consult your financial plan, consider your future needs, and avoid overly optimistic assumptions.

Overlooking Capital Gains Tax and Property Tax Implications

Failing to account for capital gains tax and potential property tax changes can lead to unpleasant surprises after selling your home. Some retirees realize only after the fact that their gains exceed the exclusion threshold, resulting in a large and unexpected tax bill. Others move into a new area with higher property tax rates, offsetting any anticipated savings. Consult both a tax planning professional and a real estate agent knowledgeable in retirement transitions to avoid these common pitfalls.

Failing to Plan for Closing Costs and Other Expenses

Overlooking closing costs and associated moving expenses can whittle away at your profits. Real estate transactions come with fees—some visible, some not—and retirees must budget for every step. Include costs for movers, repairs, appraisal, title fees, and temporary housing in your financial plan, ensuring a smooth move and a positive cash flow outcome.

- Create a comprehensive financial plan with help from a financial advisor.

- Estimate and include all expected closing costs and moving expenses.

- Research capital gains tax and property tax changes before making a move.

- Clarify your goals—be specific about what you want your retirement to look like.

- Work with an experienced real estate agent who understands the retirement market.

Is Downsizing a Good Idea for Retirement?

Analyzing Pros, Cons, and the Impact on Your Financial Plan

Is downsizing in retirement the right choice for you? The answer depends on your unique financial situation, personal goals, and lifestyle desires. On the plus side, downsizing can provide a substantial influx of cash, reduce property taxes and housing costs, and lessen the demands of home maintenance. It can also help simplify your life by enabling you to live in a community or home that better matches your needs.

On the other hand, moving can come with significant emotional challenges, especially if you’re leaving a longtime family home. And unless carefully planned, hidden costs—such as higher community HOA fees or unexpected gains tax—can diminish the expected financial benefit. Weigh your options carefully by reviewing your comprehensive financial plan, considering both the short-term and long-term impacts of your decision.

Real Examples: How Downsizing and Retirement Planning Changed Retirees’ Lives

Many retirees who have chosen to downsize report higher satisfaction with their lifestyle and finances. Take, for example, a couple who sold their family home and moved into a modern condo within a retirement community; by freeing up a large sum in equity and dramatically reducing their monthly outlays, they were able to travel, pursue interests, and spend more time with grandchildren. Another retiree used the proceeds from selling his home to create a buffer in his retirement plan, helping him ride out market downturns and medical emergencies with confidence. These real-life examples highlight that, with careful planning, downsizing and retirement planning not only boost financial security but can provide a better quality of life for years to come.

- Desire to reduce maintenance costs and home upkeep

- Interest in moving closer to family or healthcare

- Wishing for better amenities or community living

- Looking to free up equity for travel, investment, or gifting

- Wanting to simplify your life and streamline your estate plan

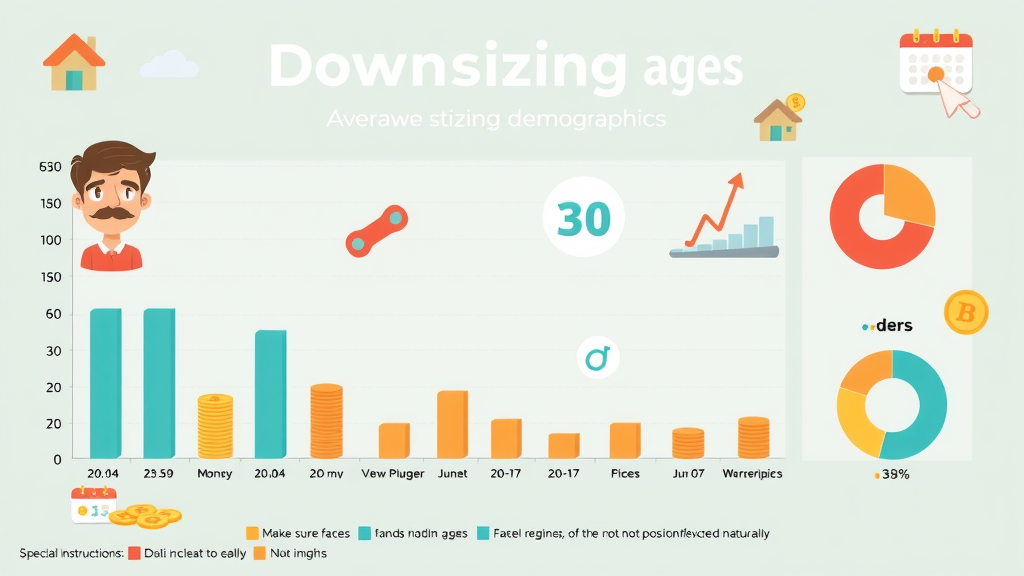

At What Age Do Most Seniors Downsize?

Age Trends, Timing, and Financial Situation Considerations

Most seniors consider downsizing between the ages of 62 and 75, though the “right time” depends on personal health, the local real estate market, and preferences for community or independent living. Trends suggest that those who plan proactively—at least 2-5 years before full retirement—enjoy a smoother transition with better financial results. The main considerations are your current health, retirement savings, desired lifestyle, and the scope of your estate plan. Remember to review your social security eligibility and ensure downsizing aligns with your broader financial situation.

Waiting too long can mean missed opportunities for tax benefit, property tax reduction, or may force you to make decisions under stress. In contrast, downsizing too early may not maximize your home’s market value. The key is to make your move part of a carefully constructed financial plan, with ongoing adjustments as circumstances change.

Data Table: Average Downsizing Age and Retirement Savings by Cohort

| Age Group | Average Downsizing Age | Median Retirement Savings | Most Common Reason for Downsizing |

|---|---|---|---|

| 55-64 | 62 | $200,000 | Lower maintenance costs |

| 65-74 | 68 | $250,000 | Free up equity/travel |

| 75+ | 74 | $180,000 | Improved accessibility |

What Are the Three Biggest Mistakes When It Comes to Retirement Planning?

Mistake 1: Overestimating the Sale Value of the Current Home

A common pitfall in retirement planning is assuming your current home will sell for top dollar, regardless of market conditions. Overenthusiasm can lead to budgeting errors, especially if your final proceeds fall short of expectations. Always be conservative with your estimates, consult several real estate agents for valuations, and adjust your financial plan should the market turn.

Mistake 2: Neglecting a Comprehensive Financial Plan and Ignoring Closing Costs

Many retirees neglect comprehensive financial planning, which includes not only the proceeds from selling your home but also ongoing expenses, taxes, and closing costs. Hidden fees, repairs, and transaction costs can impact your available funds. Ensure your financial plan is detailed, accurate, and forward-looking before making big decisions.

Mistake 3: Underestimating Capital Gains Tax and Property Tax Issues

Capital gains tax is often underestimated, with retirees surprised by liability that erodes their anticipated profit. Similarly, new property tax rates or structures on a smaller home can affect monthly budgets. Build in buffers within your financial plan to account for tax planning issues, and always consult with a tax professional to avoid foreseen and unforeseen liabilities.

What Are the Negatives of a Downsize?

Potential Disadvantages and Emotional Impacts of Downsizing and Retirement Planning

Despite numerous financial benefits, downsizing and retirement planning also come with emotional challenges. Leaving a beloved family home can trigger feelings of loss or nostalgia, especially if it’s linked to memories or community ties. There’s often an adjustment period—a sense of mourning old routines before embracing new freedoms. Social circles may change, too, particularly if the move involves relocating far from familiar friends and support structures.

On the practical side, not all downsizing scenarios deliver on promised cost or lifestyle savings. Some retirees experience unexpected fees, regret after selling during a market downturn, or disappointment with amenities in a new community. Anticipating and discussing these risks as part of your planning process can reduce the emotional and financial downsides of your move.

Strategies for Overcoming Common Challenges

To overcome the challenges of downsizing, address the emotional aspects head-on. Take time to honor your feelings and involve family or friends in the decision-making process. Consider gradual steps: declutter over several months, visit potential neighborhoods in advance, and focus on how your move supports your future financial security and independence. Use a professional real estate agent with experience in retirement transitions, and don’t hesitate to seek emotional support or counseling should you need it.

Remember, careful planning—including realistic cash flow and lifestyle adjustments—can help you navigate the downsizing process with confidence. The transition may not be easy, but the opportunities for personal growth and renewed purpose often outweigh the initial discomfort.

Frequently Asked Questions About Downsizing and Retirement Planning

-

Is downsizing a good idea for retirement?

Downsizing is often a smart financial and lifestyle choice for retirees, offering lower costs, less upkeep, and a fresh start. However, it requires careful financial planning to ensure tax, moving, and emotional costs are understood and managed. -

At what age do most seniors downsize?

Most seniors downsize between ages 62 and 75, guided by financial situation, health, and housing market trends. Planning ahead yields the best outcomes. -

What are the three biggest mistakes when it comes to retirement planning?

Overestimating home sale value, neglecting a full financial plan (with all closing costs), and underestimating gains tax or property tax implications rank as the top three pitfalls. -

What are the negatives of a downsize?

Downsides can include emotional stress, disruption of social connections, potential hidden costs, and regret if the move wasn’t carefully planned or timed. -

What are essential financial planning steps before downsizing?

Assess your financial situation, estimate all moving and transaction costs, plan for tax events, align your lifestyle goals, and consult advisors knowledgeable in real estate, tax, and retirement planning.

Expert Insights: Quotes from Financial Planners on Downsizing and Retirement Planning

"A well-timed downsize can be the cornerstone of a solid retirement strategy—helping you save money, reduce property tax, and bolster your long-term financial situation."

Key Steps Forward in Downsizing and Retirement Planning: Achieve Your Best Retirement

- Start early—give yourself time to evaluate opportunities and risks.

- Build and update a comprehensive financial plan for your retirement years.

- Include tax benefit and property tax scenarios in all calculations.

- Create checklists for decluttering, moving, and settling into your new home.

- Seek advice from experienced real estate and financial planning professionals.

Take Action to Secure Your Future: Consult a Financial Advisor Today

Take your first step toward smarter downsizing and retirement planning : reach out to a qualified financial advisor or estate agent to tailor a plan just for you.

Add Row

Add Row  Add

Add

Write A Comment